Hidden Costs of Renting in Jamaica

Renting a property in Jamaica can be an exciting step, whether you’re moving locally or relocating from abroad. However, there are often hidden costs that many renters overlook when budgeting for their new home. These costs can add up quickly and have an impact on your overall financial plan. In this blog, we’ll uncover some of the hidden costs of renting in Jamaica that you should be aware of before signing a lease.

1. Security Deposit

One of the most common hidden costs is the security deposit. In Jamaica, landlords typically require a security deposit equivalent to one or two months' rent before you move in. This deposit is meant to cover any damages to the property during your tenancy. While you may get this money back at the end of your lease, it’s important to budget for it upfront, as it can be a significant initial cost.

2. Utility Bills

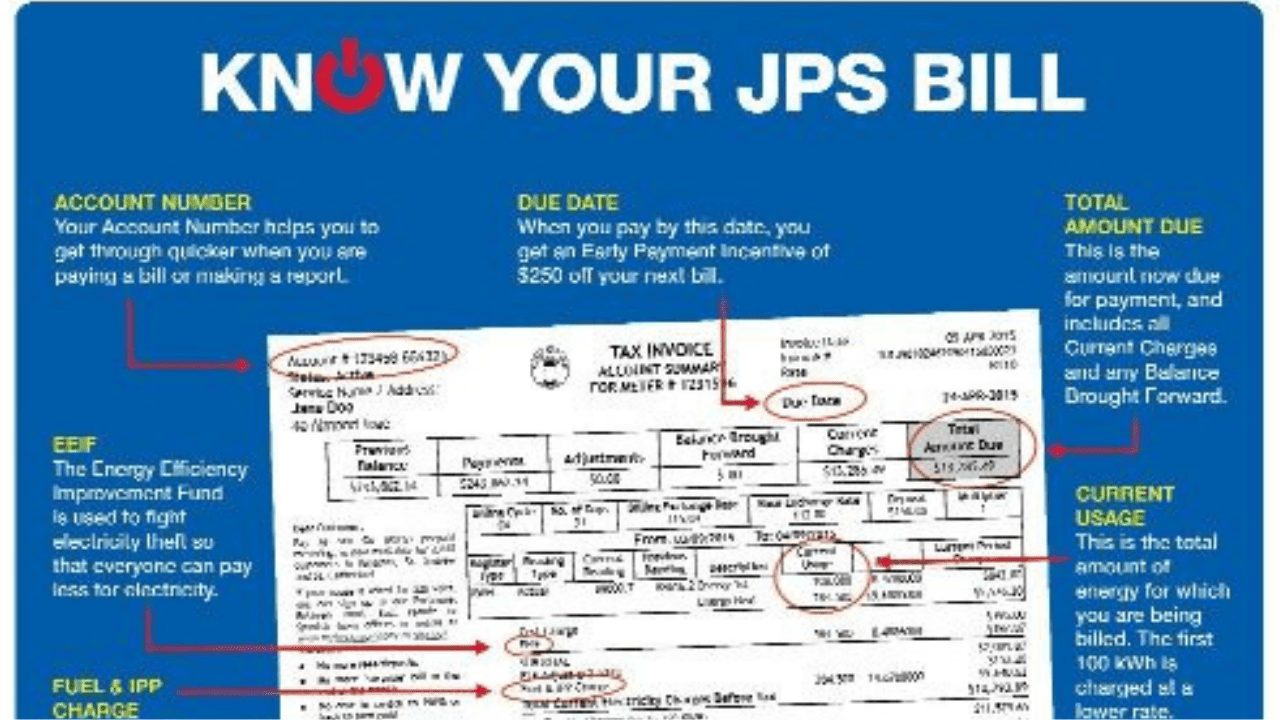

Some rental agreements in Jamaica may include the cost of utilities, but in many cases, you’ll need to cover these expenses yourself. Common utilities such as water, electricity, gas, and internet can add a substantial amount to your monthly living costs. Be sure to ask your landlord whether utilities are included in your rent and, if not, get an estimate of these costs to help with budgeting.

The cost of electricity in Jamaica can be particularly high, especially if you’re running air conditioning frequently or living in a larger home. Understanding your energy consumption and the rates in your area will help you avoid bill shock.

3. Maintenance Fees

In some rental properties, particularly in gated communities or apartment complexes, tenants may be required to pay maintenance fees. These fees cover the cost of upkeep for communal areas like swimming pools, gyms, and gardens. While these amenities can add value to your rental experience, the fees associated with them can add to your monthly expenses. Always ask your landlord whether these fees are included in the rent or if you will need to pay them separately.

4. Furnishing Costs

Renting an unfurnished property can seem like a cost-saving option, but furnishing a home from scratch can be expensive. You’ll need to account for the cost of furniture, appliances, kitchenware, and other essentials. Some renters also opt for semi-furnished properties, which may come with basic appliances but still require additional purchases.

If you’re renting for a short term, renting furniture may be another option, but this also comes with its own set of expenses. Consider these potential costs when deciding between furnished and unfurnished rentals.

5. Repairs and Maintenance

While landlords are typically responsible for major repairs and maintenance, there may be smaller upkeep tasks that fall on the tenant. Minor repairs, such as fixing a leaky faucet or replacing a broken light fixture, can quickly add up. Some landlords may expect tenants to handle certain repairs themselves, so make sure to clarify the terms of your rental agreement before moving in.

6. Parking Fees

If you live in an urban area or a high-demand neighborhood, parking can be an additional cost. Some apartment complexes charge for parking spaces, and in some areas, street parking may require a permit or fee. If you have a vehicle, check whether parking is included in your rent or if you’ll need to pay for a designated spot.

7. Renters Insurance

Renters insurance is often overlooked but can be an essential cost to protect your belongings in case of damage, theft, or natural disasters. In Jamaica, renters insurance is not typically required by landlords, but it’s worth considering, especially if you have valuable items like electronics, jewelry, or furniture. The cost of renters insurance is usually minimal compared to the protection it provides, but it’s still a monthly expense to consider.

8. Pet Deposits and Fees

If you have a pet, you may encounter additional deposits or monthly fees when renting. Some landlords charge a non-refundable pet deposit or an extra fee to cover any potential damages caused by pets. Additionally, certain properties may have restrictions on the size or type of pet allowed, so it’s important to clarify the rules and costs before signing your lease.

9. Move-In and Move-Out Costs

Moving in and out of a rental property can come with its own set of costs. If you’re using professional movers, the fees can vary depending on the distance and the amount of belongings you’re transporting. Additionally, some landlords charge a cleaning fee when you move out, especially if the property needs extensive cleaning or repairs. To avoid unexpected costs, ask your landlord about any move-out requirements.

10. Rental Increases

While not an immediate cost, rental increases can sneak up on you if you’re not prepared. In Jamaica, landlords are allowed to increase rent after a certain period, especially if the lease is renewed. Always review the terms of your lease for any clauses regarding rental increases and budget accordingly for potential hikes during your tenancy.

Conclusion

Renting a property in Jamaica can be a great option, but it’s important to be aware of the hidden costs that can arise. From security deposits and utility bills to maintenance fees and parking costs, these expenses can quickly add up. Before signing a lease, make sure you understand all potential costs and budget for them accordingly. By being prepared, you’ll avoid any financial surprises and enjoy a smooth renting experience.