How to Budget for Renting in Jamaica

How to Budget for Renting in Jamaica

Renting in Jamaica, whether you're a local or an expat, requires careful planning and budgeting to ensure that you can comfortably afford your living space. Here’s a step-by-step guide to help you create a realistic budget for renting in Jamaica:

1. Determine Your Monthly Income

The first step in budgeting is understanding how much money you have coming in each month. Include all sources of income, such as salary, business profits, or investments. A good rule of thumb is to allocate no more than 30-35% of your monthly income towards rent.

2. Research Average Rent Prices

Rent varies depending on the location, property type, and size. For example, apartments in Kingston or Montego Bay will typically cost more than in smaller towns or rural areas. On average:

- 1-bedroom apartments in central areas may cost JMD 50,000 – 100,000 per month.

- 2-bedroom apartments or houses in popular neighborhoods may range from JMD 80,000 – 150,000 or more.

3. Consider Additional Costs

Beyond rent, factor in the following:

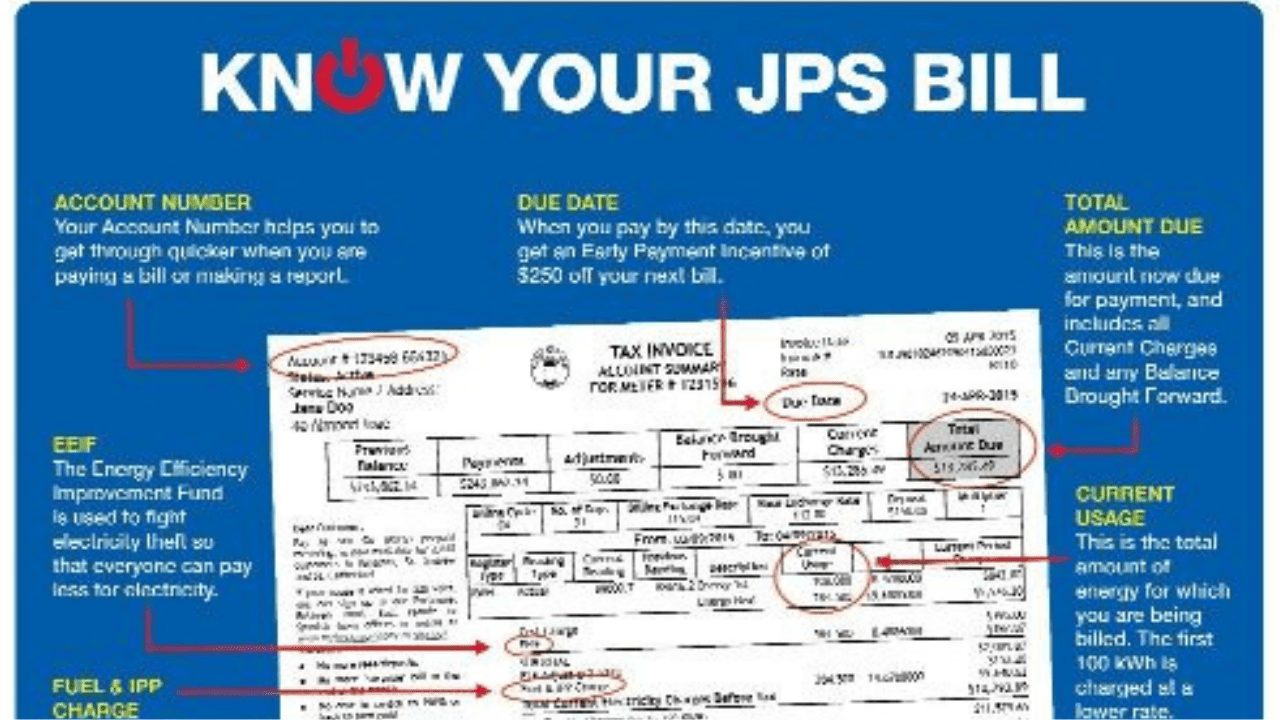

- Utilities: Electricity, water, and internet costs may or may not be included in the rent. Expect to pay JMD 5,000 – 20,000 per month for utilities, depending on your usage.

- Security Deposit: Most landlords require a security deposit equivalent to one or two months’ rent upfront.

- Maintenance Fees: In gated communities or apartment complexes, there may be maintenance fees for shared spaces or security.

- Furnishing: If the property is unfurnished, you’ll need to budget for furniture, appliances, and other essentials.

4. Estimate Moving Costs

Moving into a new rental comes with costs like:

- Hiring movers or renting a vehicle.

- Setting up utilities such as electricity, water, and internet if they’re not already connected.

5. Account for Transportation

If you’re renting in a central area like Kingston or Montego Bay, you may be able to rely on public transportation. However, if you’re further from city centers, consider the cost of owning a vehicle or commuting. Fuel, insurance, and maintenance for cars can add up quickly.

6. Create a Contingency Fund

Unexpected expenses can arise, so it’s wise to set aside 10-15% of your budget for emergencies, repairs, or rent increases. This will give you peace of mind in case of unforeseen circumstances.

7. Review Your Budget Regularly

After moving in, keep track of your expenses for a few months to ensure your budget is accurate. Adjust it as needed to accommodate changes in rent, utilities, or other living costs.

By carefully planning and accounting for all expenses, you can enjoy a comfortable rental experience in Jamaica without financial strain.